SUN VILLAS ONSEN QUANG HANH - KHU NGHỈ DƯỠNG KHOÁNG NÓNG TẬP ĐOÀN SUN GROUP

Khu nghỉ dưỡng khoáng nóng Biệt thự Sun Villas Onsen Quang Hanh. Không phụ sự kỳ vọng và mong đợi của nhiều nhà đầu tư, sau 5 tháng đi vào vận hành chính thức, sắp tới đây chủ đầu tư Sun Group sẽ chính thức mở bán các sản phẩm bất động sản tại dự án Yoko Onsen Quang Hanh. Mở ra cơ hội đầu tư bất động sản nghỉ dưỡng khoáng nóng, đón đầu xu hướng tại Việt Nam cho giới địa ốc.

Một khu đô thị biển đẳng cấp mang phong cách Nhật Bản với hệ thống suối khoáng nóng có 1.0.2 được xây dựng tại Quang Hanh dự báo sẽ là “cơn sốt” đầu tư bất động sản Quảng Ninh trong thời gian tới.

KHU NGHỈ DƯỠNG KHOÁNG NÓNG - SUN VILLAS ONSEN QUANH HANH

Tên dự án: Khu nghỉ dưỡng khoáng nóng Sun Onsen Villas Quang Hanh

- Vị trí : Phường Quang Hanh, TP. Cẩm Phả, Quảng Ninh

- Chủ đầu tư: Tập đoàn Sun group.

- Phong cách kiến trúc: Nhật Bản

- Quy mô: hơn 1000 ha bao gồm các hạng mục: Yoko Onsen, Villa, shop, Yoko Park Hyatt…

- Loại hình bất động sản đầu tư: biệt thự tứ lập, song lập, đơn lập, shophouse thương mại.

- Tiêu chuẩn hoàn thiện: Full đồ

- Chiều cao: Xây dựng 2 tầng, đảm bảo tối thiểu 3 phòng ngủ/villa

- Hình thức sở hữu: lâu dài

LIÊN HỆ CSKH DỰ ÁN KHU NGHỈ DƯỠNG KHOÁNG NÓN ONSEN QUANG HANH : 0906.886.882 | 0777.23.8686

ĐÁNH GIÁ TIỀM NĂNG ĐẦU TƯ & PHÁT TRIỂN DỰ ÁN KHOÁNG NÓNG SUN VILLAS ONSEN QUANG HANH, QUẢNG NINH

Vận hành từ tháng 5/2020 đến nay, dự án Yoko Onsen Quang Hanh thu hút được đông đảo du khách du lịch và nghỉ dưỡng, trải nghiệm dịch vụ khoáng nóng. Đây là khu nghỉ dưỡng cung cấp các dịch vụ trải nghiệm độc đáo đầu tiên tại Việt Nam như:

- Khu tắm khoáng Onsen

- Khu trị liệu cao cấp

- Khu nghỉ theo mô hình nhà Nhật cổ truyền

- Khu spa rộng lớn

- Khu ẩm thực, nhà hàng organic…

Có thể nói, lần đầu tiên tại Việt Nam có quần thể biệt thự và shophouse gắn liền với khoáng nóng. Dự án được lên ý tưởng quy hoạch tất cả 200 căn biệt thự khoáng nóng, 100 căn shophouse để mang đến cho du khách điểm hẹn lưu trú và trải nghiệm dịch vụ khoáng nóng thú vị.

Đánh giá về tiềm năng phát triển du lịch trải nghiệm khoáng nóng, nhiều chuyên gia cho biết loại hình này có tiềm năng lớn tại Việt Nam.

- Thứ nhất : Hiện tại loại hình bất động sản nghỉ dưỡng đã không còn xa lạ với giới địa ốc. Ngược lại, được ưa chuộng. Song, vì hiệu quả đầu tư và khả năng bão hoà, hiện tại những nhà đầu tư sành sỏi hướng tới những giải pháp mới và khác biệt. Yoko Onsen Quang Hanh giải quyết được điều đó.

- Thứ hai : Tài nguyên khoáng nóng tại Việt Nam chưa được khai thác nhiều. Nguồn tài nguyên cũng rất hữu hạn. Những vị trí, mảnh đất có thể phát triển theo mô hình nghỉ dưỡng khoáng nóng rất khan hiếm. Vì vậy, đầu tư vào bất động sản kết hợp khoáng nóng sẽ không lo sản phẩm bị bão hoà hay giá trị thấp. Ngược lại, đây là cơ hội đầu tư hấp dẫn cho những nhà đầu tư coi trọng lãi vốn.

- Thứ ba : Mô hình khoáng nóng Nhật Bản tại dự án Yoko Onsen Quang Hanh mang phong cách sống mới: Tinh thần Nhật Bản – Trải nghiệm; kết hợp với trị liệu và chăm sóc sức khoẻ tạo nên một lối sống lành mạnh.

Với những phân tích trên, Yoko Quang Hanh được đánh giá là kênh đầu tư đầy tiềm năng. Đáng giá cho nhà đầu tư xuống tiền ngay thời điểm này.

(Khách hàng quan tâm mời ĐĂNG KÝ để nhận bảng giá chi tiết từng dự án ngay bên dưới)

ĐÁNH GIÁ VỊ TRÍ KHU NGHỈ DƯỠNG SUN VILLAS ONSEN TẠI QUANG HANH, QUẢNG NINH

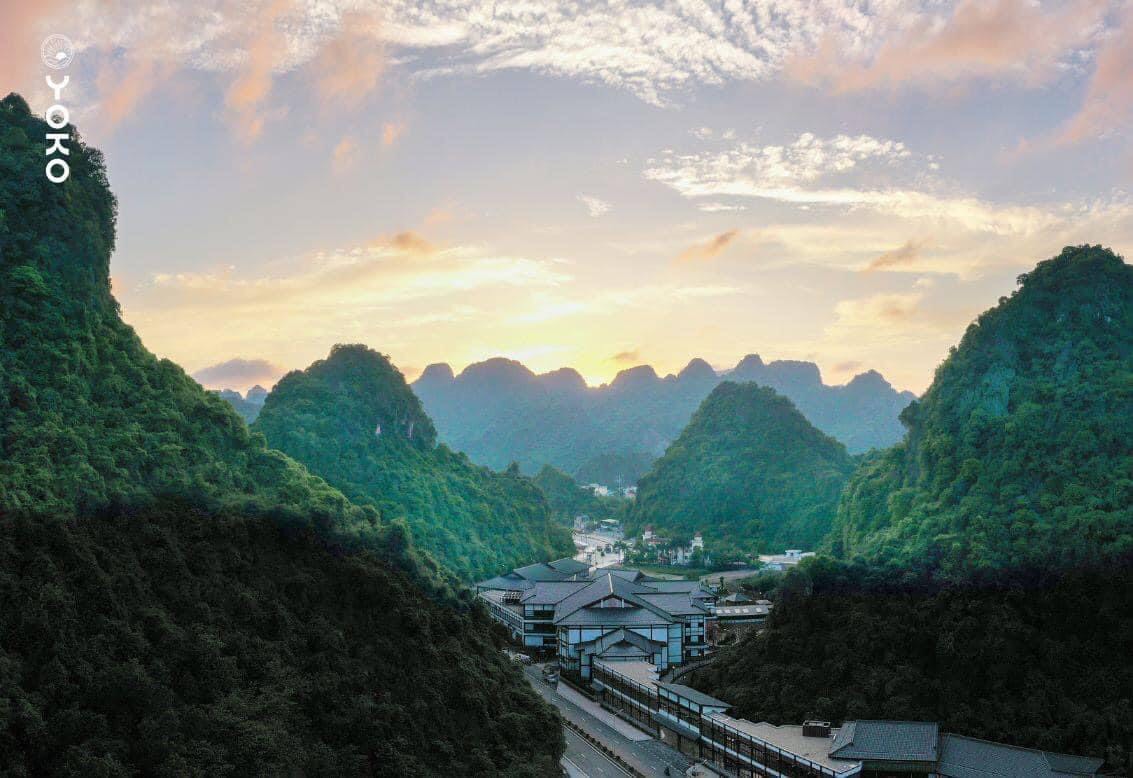

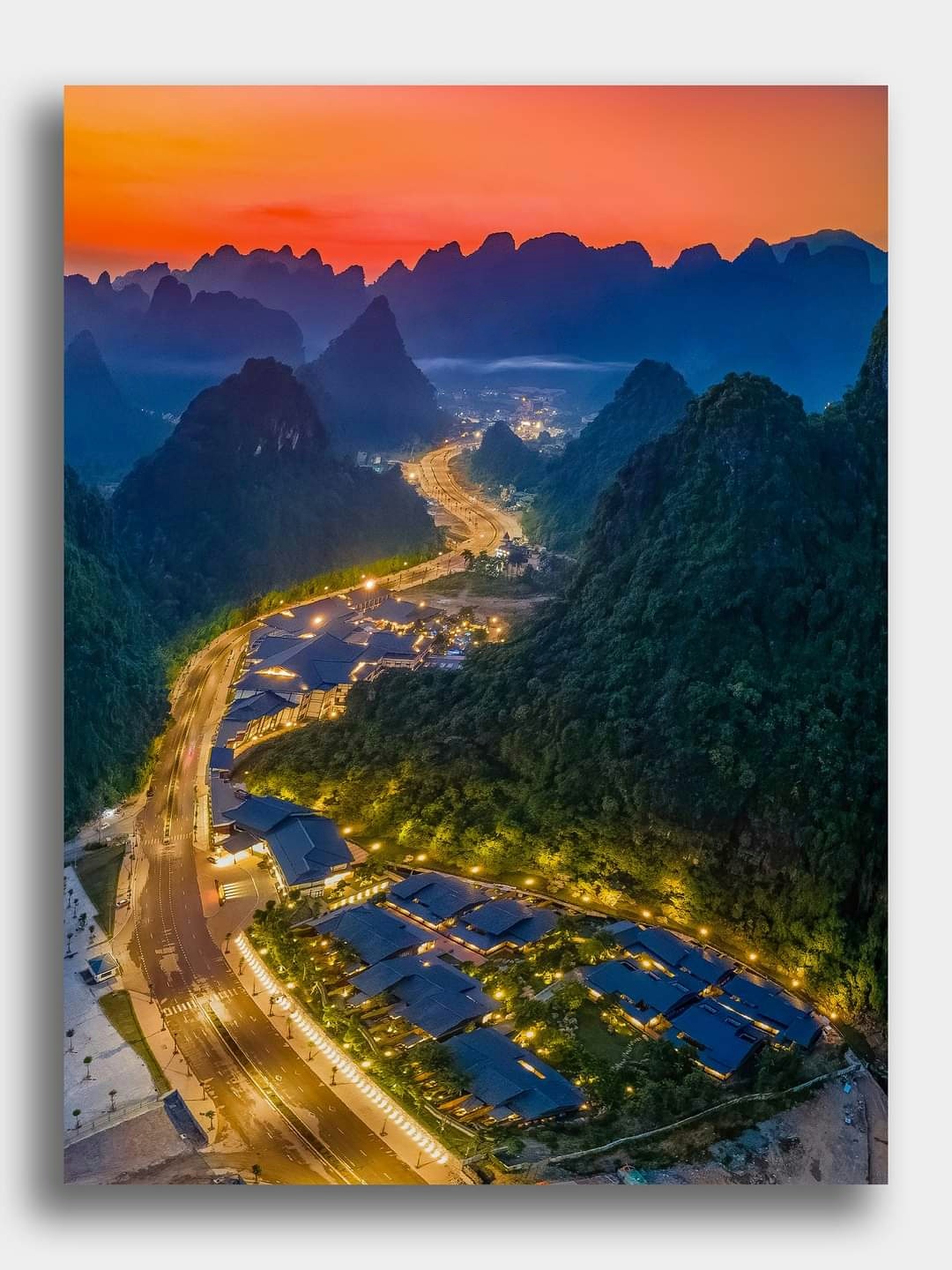

Toạ lạc tại tổ 5, khu 9B, phường Quang Hanh, Cẩm Phả, Quảng Ninh, dự án được đánh giá cao về khả năng liên kết vùng; tiện ích và dịch vụ nội khu. Liên kết vùng với một số điểm nổi tiếng của Quảng Ninh như Hạ Long, đảo Cát Bà, sân bay Cát Bi rất thuận lợi.

- Dự án cách thành phố Hạ Long 16km

- Cách đảo Cát Bà 36km

- Cách sân bay Cát Bi 56km

Vị trí của dự án không phải những khu trung tâm nội thành nhộn nhịp mà nằm trên eo đường được bao bọc bởi những dãy núi xanh mát và trong lành. Điều này đúng với tinh thần và không gian của một khu nghỉ dưỡng khoáng nóng Sun Group hướng tới.

Sau gần 5 tháng đi vào vận hành và đón du khách trải nghiệm; khu nghỉ dưỡng Yoko Onsen Quang Hanh đã thu hút đông đảo khách. Điều này cũng chứng minh chiến lược phát triển và chọn vị trí của chủ đầu tư Sun Group là vô cùng đúng đắn.

SẢN PHẨM NGHỈ DƯỠNG ONSEN QUANG HANH, CẨM PHẢ, QUẢNG NINH

Mang trong mình phong cách nghỉ dưỡng chuẩn Nhật Bản - Dự án khoáng nóng nghỉ dưỡng Onsen Quang Hanh Villas được Tập đoàn Sun Group xây dựng và phát triển với các loại hình bất động sản nghỉ dưỡng như sau :

- Biệt thự nghỉ dưỡng đơn lập giáp

- Biệt thự nghỉ dưỡng tứ lập

- Biệt thự nghỉ dưỡng song lập

- Nhà phố Shophouse thương mại dịch vụ

AN TÂM ĐẦU TƯ VỚI UY TÍN CHỦ ĐẦU TƯ DỰ ÁN ONSEN QUANG HANH VILLAS – SUN GROUP

Chủ đầu tư của dự án cũng là điểm cộng để nhà đầu tư an tâm mua biệt thự Yoko Onsen Quang Hanh. Sun Group với những thành tựu của mình trên thị trường bất động sản nói chung và nghỉ dưỡng nói riêng đủ để thuyết phục nhà đầu tư an tâm đầu tư.

Trải dọc từ Bắc vào Nam, Sun Group đều có những dự án bất động sản của mình. Đặc biệt, trong vài năm trở lại đây chủ đầu tư Sun Group đã khai thác mạnh ở phân khúc nghỉ dưỡng. Những khu vực trọng điểm như Đà Nẵng, Nha Trang, Phú Quốc, Quy Nhơn, Quảng Ninh… đều có sự góp mặt của “ông lớn” này. Có thể nói, từ khi phân khúc này còn manh nha thì Sun Group cùng với Vingroup đã trở thành 2 thương hiệu lớn được biết tới. Nhắc tới bất động sản nghỉ dưỡng, từ các nhà đầu tư sành sỏi cho đến tay mơ đều biết tới 2 “ông lớn” này.

Thủ tướng Nguyễn Xuân Phúc cắt băng khánh thành dự án Yoko Onsen Quang Hanh

THÔNG TIN QUY HOẠCH VÀ THIẾT KẾ NỔI BẬT CỦA BIỆT THỰ SUN ONSEN VILLAS QUANG HANH

- Dự án Yoko Onsen Quang có quy hoạch đồng bộ. Cụ thể, 200 căn biệt thự tại dự án được thiết kế đúng phong cách Nhật. Mỗi căn biệt thự đều được thiết kế bể tắm nóng, bể ngâm và sục với nguồn khoáng nóng tinh khiết được dẫn vào từng nhà để du khách có thể trải nghiệm trong không gian riêng tư. Mục tiêu của Sun Group là hy vọng khách hàng có khoảng thời gian để thư giãn, trị liệu sức khoẻ và nuôi dưỡng tinh thần tốt nhất tại từng khoảnh khắc.

- Các căn biệt thự tại đây còn được thừa hưởng quy hoạch đồng bộ của cả tổ hợp. Với những hạng mục nổi bật như cảnh quan khu nghỉ dưỡng có phong cách chuẩn Nhật Bản. Đó là hồ cá koi, vườn Tùng Bách bonsai, cổng Tori, lồng đèn truyền thống…

- Hơn thế, khu nghỉ dưỡng có khả năng khai thác kinh doanh 4 mùa, đảm bảo thu về lợi nhuận tối đa cho nhà đầu tư.

- Thời gian tới, chủ đầu tư Sun Group sẽ hé lộ nhiều thông tin hấp dẫn khác liên quan đến dự án Yoko Onsen Quang Hanh Cẩm Phả như: bảng hàng, giá bán, chính sách bán hàng,… Hứng thú và nhắm tới thị trường này, nhà đầu tư nên nắm bắt thông tin sớm nhất.